A new LifeWay Research survey indicates that most Southern Baptist pastors don’t think the members of their congregation have a significant amount of debt, and a South Carolina Baptist Convention stewardship expert says many pastors don’t deal aggressively with stewardship issues because they are shouldering heavy personal debt themselves.

While almost two-thirds of Southern Baptist pastors have preached on stewardship in the past year, the new study shows that few of those pastors believe members of their congregation have a significant amount of debt, revealing a serious disconnect with the realities of American family life.

The survey of 3,500 Southern Baptist senior pastors was conducted by LifeWay Research on behalf of the Executive Committee of the Southern Baptist Convention between November 2007 and February 2008. The study revealed that 65 percent of pastors had preached on financial stewardship during the previous year, but only 25 percent said their church members have “a significant amount of personal debt.”

That stands in stark contrast to national statistics about the debt load American families are carrying, said Scott McConnell, associate director of LifeWay Research.

“In 2006, household debt in America grew by $1.2 trillion – a one-year increase larger than the total amount of household debt just 30 years ago,” said McConnell.

“The average American is struggling with oppressive debt; they are spending $1.26 for every dollar earned,” said Bob Rodgers, vice president for Cooperative Program and stewardship with the Executive Committee of the Southern Baptist Convention.

Gary Anderson, director of the Cooperative Program and stewardship group of the South Carolina Baptist Convention, said one of the reasons many pastors are not “more open and aggressive” with stewardship issues is they are dealing with serious debt issues themselves. He said the percentage of ministers who do not tithe is “staggering.”

According to the survey, church members tend to look within their own congregation for guidance on promoting and teaching stewardship, according to the survey. A full 74 percent of pastors said the congregation looks to them for guidance, and 31 percent said their church turns to members of their church.

“This is an excellent opportunity for ministry to the church body and as an outreach tool to the community,” Anderson said.

Only 2 percent said church members look to an independent stewardship consultant and 9 percent look to a preferred author, while less than 1 in 4 look to their associational or state convention leadership.

The SBC Executive Committee is trying to address the disconnect between pastoral perspective and church member reality with the “It’s A New Day” financial management workshops. “It’s A New Day” is not a typical stewardship program, but rather a “how-to” workshop designed to help pastors and churches learn strategic skills to manage their money more effectively, work their way out of financial bondage and achieve a sense of spiritual well-being about the financial side of their lives.

“I am encouraged by the approach of ‘It’s A New Day’,” said Anderson. “The principle behind it is moving people toward financial freedom.?Financial freedom is defined as the emotional, intellectual, and life-changing recognition that God owns everything I have – I just manage it for God.?

“‘It’s A New Day’ is not about raising money, but about being freed from financial bondage that can separate one from a right relationship with God.?This approach can be life-changing for many who are struggling with debt issues.?

“Not only can this be transforming for church members, but a church may be amazed to see the number of people who will respond from the community when this resource is made available.? It can be a strong outreach tool.”

Anderson said several one-day workshops are being planned for 2009 in various regions across South Carolina. The workshops are designed for ministerial staff as a personal help and an introduction to a four-week church effort.?

Church members appear to be open to teaching or preaching on the subject of stewardship, according to the LifeWay survey. A full 67 percent of pastors surveyed describe their congregation as open on the subject, and another 22 percent did not see church members as closed to the matter. Only 8 percent thought their members were closed to learning more about principles of biblical stewardship and 3 percent “don’t know.”

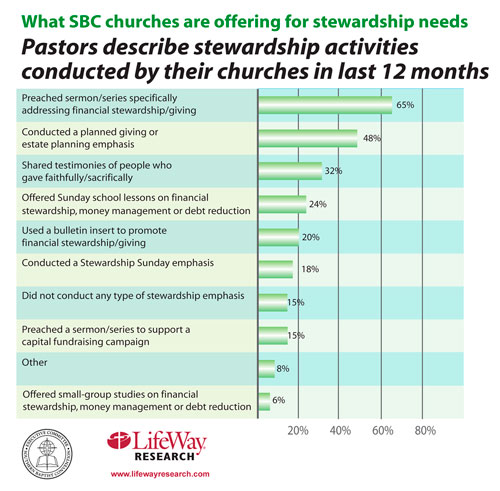

Besides preaching on the subject, congregations had used other activities in the last year to promote stewardship, the pastors said. An emphasis on planned giving or estate planning had been conducted by 48 percent, 32 percent had faithful or sacrificial givers share testimonies, 24 percent had offered Sunday school lessons, 20 percent had used a bulletin insert and 18 percent had conducted a Stewardship Sunday emphasis.

Six percent of churches had offered a small group study on financial stewardship, money management or debt reduction. Only 15 percent of the pastors said their congregations had not conducted any type of stewardship emphasis in the preceding 12 months.

The study concluded that 40 percent of the congregations had used resources offered by leading stewardship resource providers in the previous year. Churches that had used such materials were divided, in descending order: 14 percent, Crown Financial Ministries; 13 percent, Dave Ramsey; 9 percent, Larry Burkett; 6 percent, Empowering Kingdom Growth; 5 percent, Stewardship Development Association; 3 percent, Ron Blue; 2 percent, “It’s A New Day.”

According to Rodgers, one of the greatest needs of the church is for pastors to have a greater awareness of the debt load many of their church members carry and to provide resources to help them.

“When God’s people understand and practice biblical principles of money management and debt reduction, it not only increases their joy in the Christian life,” he said, “it also strengthens the church financially and enables it to minister more effectively in its community.”

Kelly is an assistant editor with Baptist Press.